2024 Third-Quarter Market Insights and 2025 Predictions

As we enter the final quarter of 2024, the Martha’s Vineyard real estate market reflects some of the broader national trends driven by persistently high mortgage interest rates. Throughout the year, elevated rates have tempered sales volume in many areas across the country, and Martha’s Vineyard is no exception.

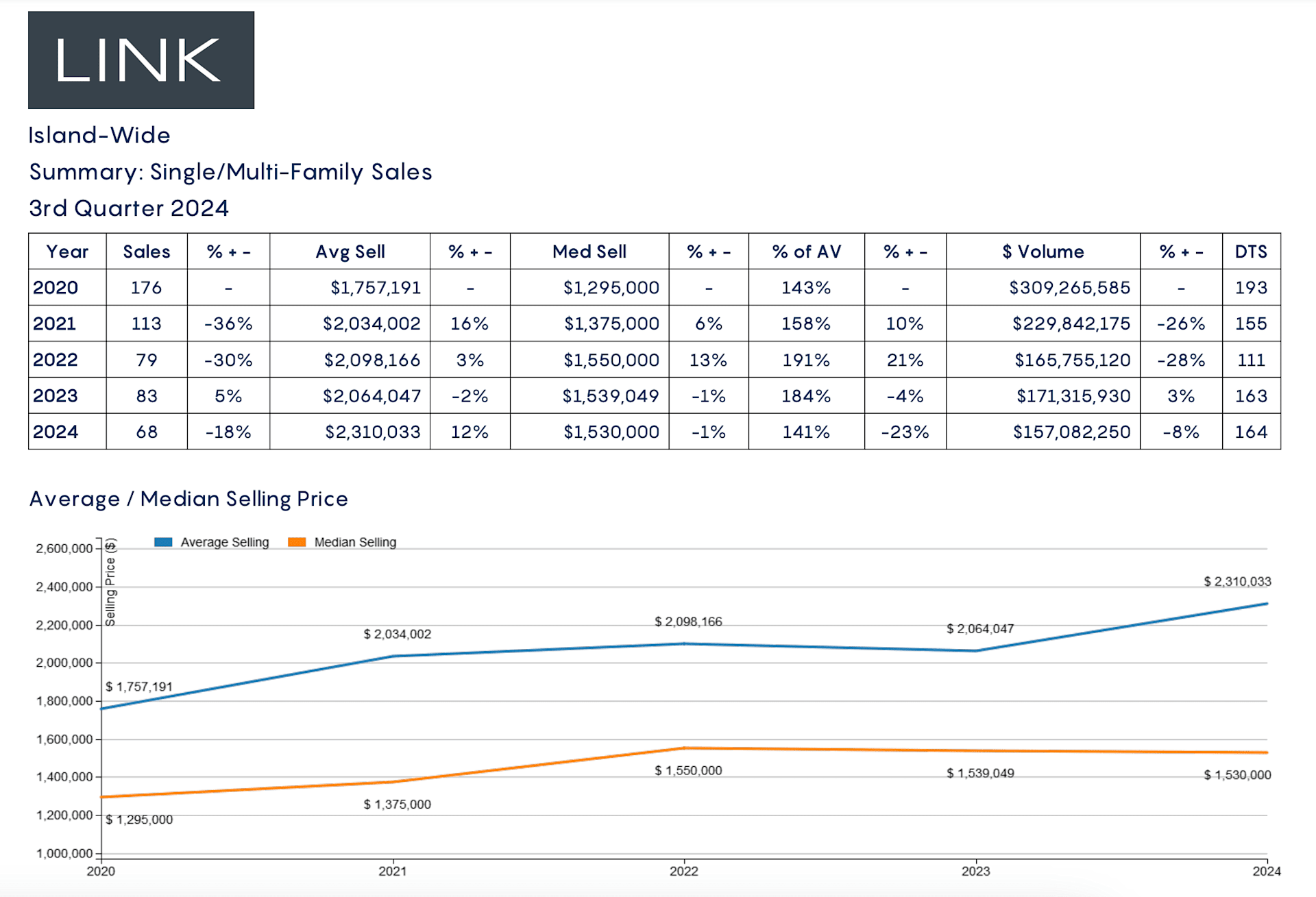

This chart from LINK’s 3rd Quarter Sales Summary illustrates a significant decline in the number of sales (see the first column) alongside three consecutive years of steady median prices. This stability shows that, even with fewer transactions, home values on the Island have remained strong since 2022.

Meanwhile,

Freddie Mac notes that the U.S. economy remains resilient with robust GDP and employment growth, though high mortgage rates and affordability challenges continue to keep sales levels suppressed, even as inflation and interest rates begin to ease.

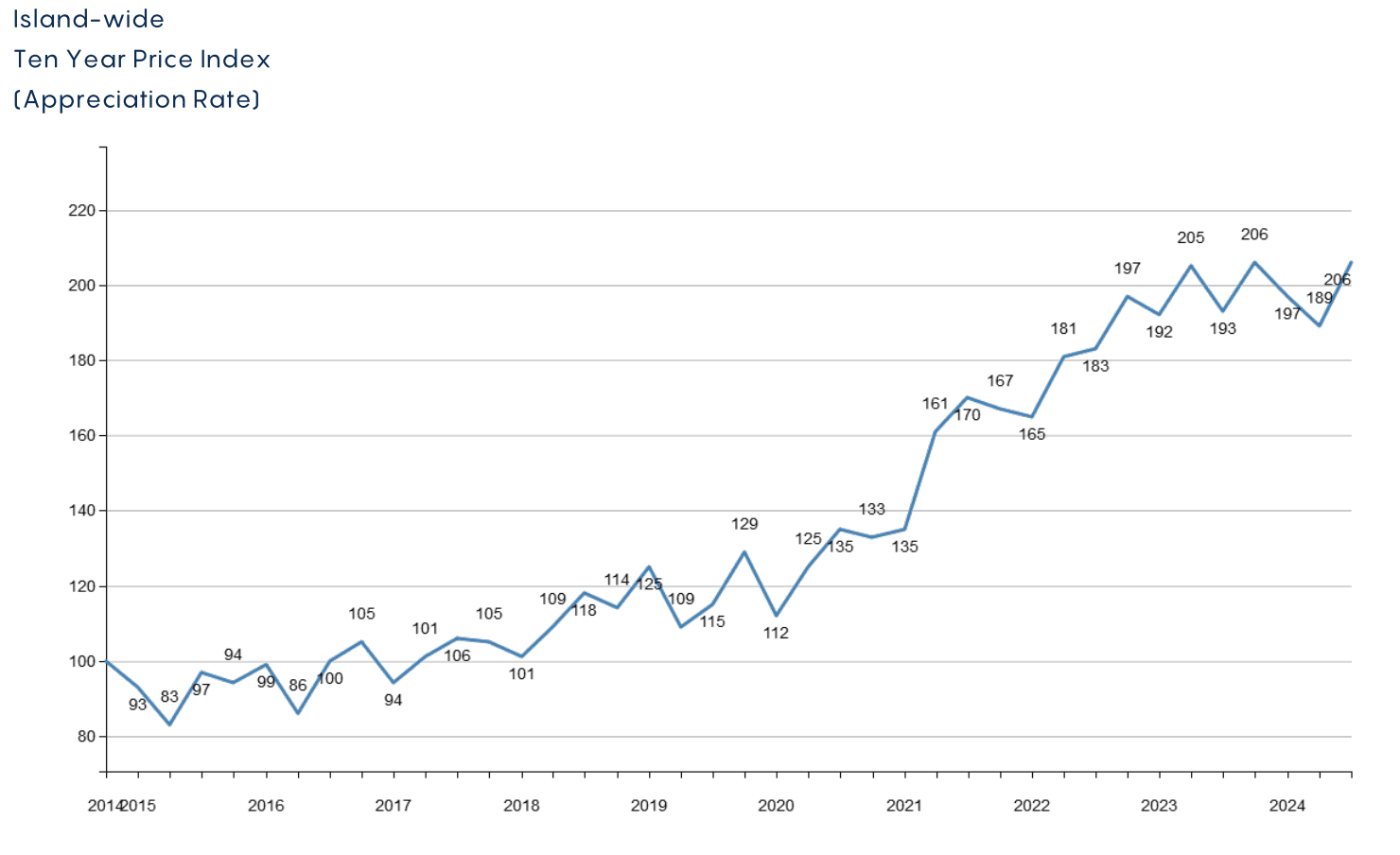

Next, this graph displays a 10-year price trend for Island homes, reinforcing that prices haven’t decreased. As you can see, there was steady appreciation before the pandemic, followed by a substantial increase during it. Over the last two years, prices have leveled off, but they haven’t declined. This stability reflects the Island’s enduring appeal and limited inventory.

There’s something else to keep in mind:

Demand has softened for properties needing major updates or renovations. These homes are taking longer to sell, with some sellers feeling the impact. Conversely, buyers continue to pay a premium for move-in-ready properties, particularly those that are new or have been updated within the past 5 to 10 years.

Looking forward to 2025 on a national scale, here’s what experts expect:

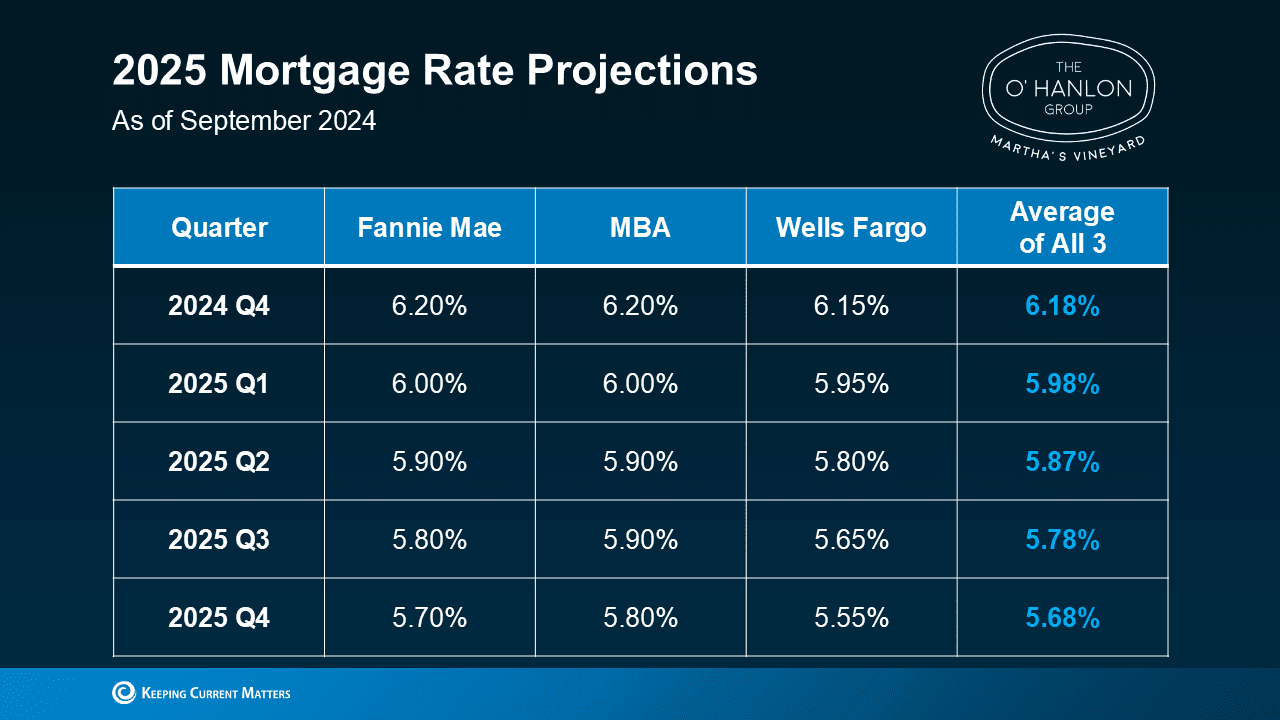

Mortgage interest rates are projected to gradually decline in 2025.

Although we’re not anticipating sharp decreases, the outlook suggests a slow easing, likely bringing more buyers back into the market. Additionally, if we examine this graph, we can see home sales are expected to rise as more buyers re-enter the market.

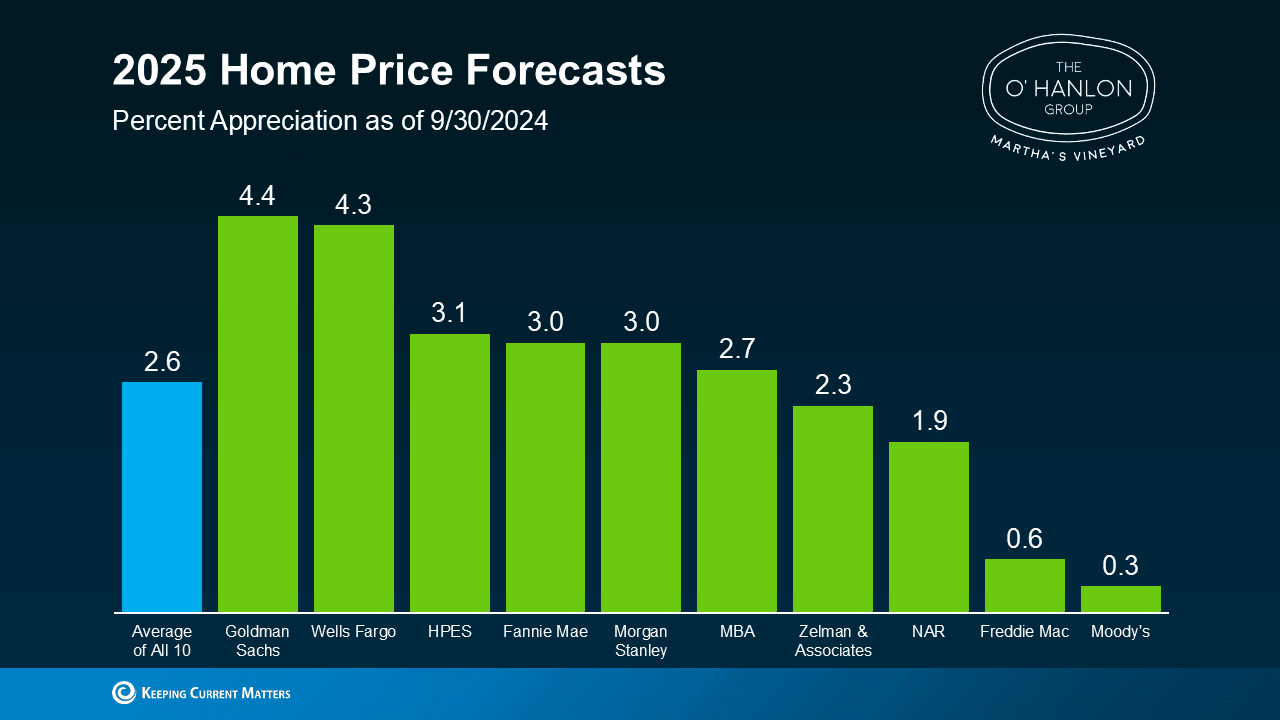

However, with rates not expected to drop dramatically, we don’t foresee significant price jumps either, with a modest 2.6% appreciation forecasted nationwide.

This Forbes article predicts that while mortgage rates may continue to decline gradually into 2025, persistent low inventory and steady demand will keep home prices elevated, though the pace of price growth is expected to slow.

So, what does this mean for buyers and sellers?

For buyers, many are holding off for rates to drop further, but entering the market now could help you avoid potential bidding wars as demand picks up in 2025, as suggested in this

U.S. News article. For sellers, while rates may ease next year, we don’t expect substantial increases in home prices, so waiting until spring might not result in significantly higher offers than what’s available now.

As always, each situation is unique. At The O'Hanlon Group, we closely monitor market trends both nationally and on Martha's Vineyard. If you’d like to discuss your options, reach out for a no-obligation consultation. We're here to help!